Completing the Journey

Written By: Troy Jensen, QKA, APA & Luke Hollister

America is facing a wave of retirements that is unprecedented in modern history. Each day in 2025, more than 11,000 Americans from the baby boomer generation will reach the retirement age of sixty-five. They will find themselves confronted by a decision they likely did not give much thought to prior to retirement: do they keep their retirement assets in their employer’s plan, roll them over to an IRA, or withdraw them as a lump-sum distribution? For most employees, the accumulation phase of saving for retirement is discussed far more frequently than the decumulation phase. Plan sponsors and retirees may be unaware of the benefits afforded to both parties by leaving assets in the plan, and the lack of awareness can often create plans that are not very friendly to retirees. A deeper understanding of these benefits can help plan sponsors better care for their participants’ assets and individual needs.

Sources: Visa Business and Economic Insights and U.S. Department of Commerce

The benefits for retirees leaving assets in the plan are numerous and can be quite consequential. First, the participant’s plan fiduciaries oversee the retirement plan fund menu. They are typically a committee of several key decision-makers and participants and may also receive input from an investment consultant. This collective group is subject to the fiduciary standard of participant asset oversight. Being a fiduciary means placing participants’ interests above the decision maker’s interests, and it requires that plan sponsors employ prudent processes in selecting investment options and conducting ongoing supervision.

Broker-dealers and other entities that sell out-of-plan investment options to retirees are not under the fiduciary standard. Instead, they must meet a suitability standard, requiring their investment advice to “suit” the investor’s objectives and needs. This is a far lower bar and fails to prevent these entities from pitching an investment vehicle not in the participant’s best interest. In this environment, some will win, some will lose, but the fiduciary standard will protect no one.

Source: Behavior Gap, 2013.

In addition to a vetted plan menu, plan participants benefit from institutional pricing agreements that may lower their investment expenses. A retirement plan’s scale and asset base allow it to access share classes or products that would not be available to retail investors, and these agreements can collectively result in materially lower fees. Furthermore, participants usually have other resources and benefits available to them through their retirement plan, such as financial planning or participant education, and these resources would be given up if assets were rolled out of the plan.

Scale also benefits the plan and, by extension, the plan sponsor. Retirees often have some of the larger account balances in the plan, and retaining those assets will allow the plan to qualify for higher minimum products and lower prices for all participants. Making plans retiree-friendly communicates that the company is looking out for the employees’ long-term interests even after they have retired.

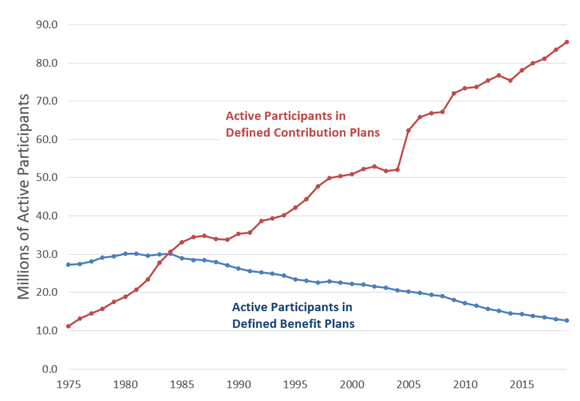

Despite the numerous benefits of keeping assets in the plan, many retirees withdraw their assets upon retirement. They may simply want to consolidate their retirement assets with one provider. However, a more common reason is the desire to access additional investment options unavailable within the plan. One option that has seen modest growth in popularity among participants is retirement income solutions. These investments mimic the guaranteed income that traditional pensions and defined benefit plans offer but often charge a relatively high fee. For many participants, the peace of mind presented by the prospect of guaranteed income is so compelling that broker-dealers and insurers who pitch these products easily persuade them. However, these income solutions can often have complex terms and opaque provisions, and participants are not as well equipped to evaluate them as plan sponsors. While not all plans need to offer retirement income solutions, plan sponsors should be aware of their participant’s interests and ensure they fulfill their obligations as fiduciaries.

Source: Congressional Research Service, December 27, 2021.

Perhaps the simplest way to make a retirement plan retiree-friendly is to increase the forms of distribution. Consider permitting installment and partial distributions instead of only offering lump sum or rollover distributions. This will allow a retiree’s assets to be distributed in variable portions throughout their retirement, which enables them to keep the bulk of their assets in the plan and protected by the fiduciary standard.

Before taking this action, plan sponsors must evaluate their participant’s needs and the objectives of their retirement plans. Some plan sponsors may prefer that their participants roll their assets out of the plan upon retirement. If this is the case, plan sponsors should clearly communicate that expectation, and it may also be helpful to provide some direction on how this can be done with minimal cost and risk to the participant. If a plan sponsor wants to make their plan more retiree-friendly, there are several steps they can take beyond increasing the forms of distribution. The plan’s recordkeeper can help the plan sponsor monitor the leakage of assets from the plan and perhaps even identify where those assets are going. In addition, the plan sponsor should take advantage of the captive audience that participants represent. Some plan sponsors have hosted a pre-retirement workshop that educates participants on the options available to them in retirement, and others have created resources that guide participants through this process. No matter what they decide, plan sponsors should construct a plan structure that will accommodate various needs while keeping participants’ interests at the center of their decisions.