Infrastructure Investing: Attractive Opportunity in Uncertain Times

Written by: Sloan Smith, CAIA, MBA, CPWA® and Luke Hollister

In a market where equity valuations are above their twenty-five-year average[1] and fixed income has failed to provide substantial inflation-adjusted returns,[2] investors may be wary of looking solely to public markets for investment options to achieve their long-term goals. In private markets, one area of investment that appears compelling is real assets, specifically, infrastructure. Allocating to “real assets” generally entails investing in physical property, such as farmland, timberland, bridges, or power plants. The asset class tends to provide stable income, potential for capital appreciation, and tax-advantaged distributions. In addition to the advantages for investors, the strong need for infrastructure real assets makes this subset of the asset class a compelling value proposition.

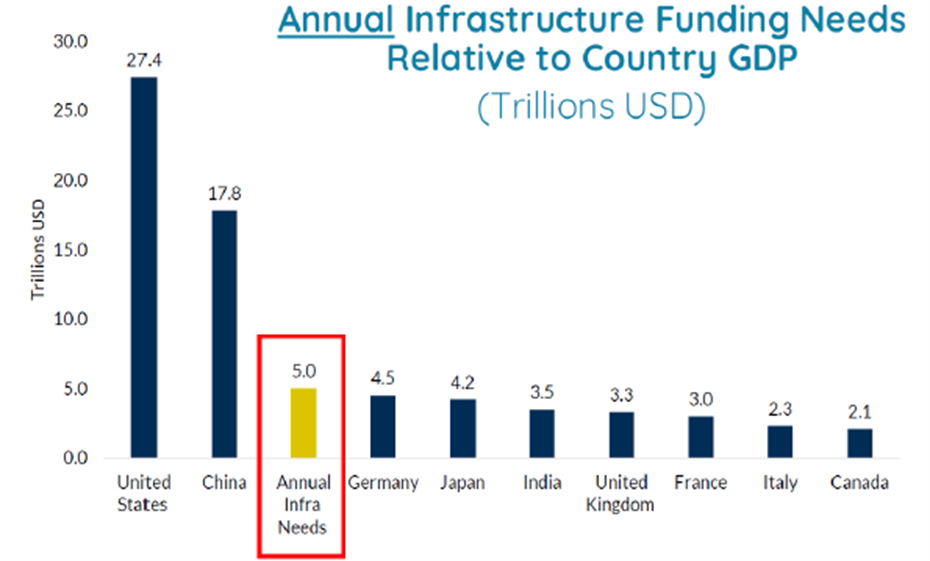

Global infrastructure is antiquated and insufficient for today’s needs, amounting to a projected worldwide need for infrastructure investment of $5 trillion per year, which is equivalent to the third-largest GDP in the world.[3]

Source: The International Renewable Energy Agency, Versus Capital.

Source: MSCI, J.P. Morgan Asset Management. Infrastructure returns represented by the MSCI Global Quarterly Infrastructure Asset Index.

In general, infrastructure investments are essential use assets with contracted revenues. They usually involve high-quality counterparties, such as governments, and the markets in which they operate tend to exhibit high barriers to entry. Although these traits are relatively specific, several different kinds of assets fit this description, including natural gas power plants, bridges, freight shipping, data centers, and cell towers. Investment managers can choose to either buy the underlying assets (e.g., a network of cell towers) and collect the income from other companies’ use of those assets or purchase businesses that own and operate the assets.

Advantages:

Infrastructure investments provide the following advantages:

Allocating to real assets exposes the investor to two kinds of return: capital appreciation, where the asset or business grows in value, and income, which is derived from the cashflows generated by the asset or business. This combination of factors helps to insulate infrastructure from a good portion of the volatility that characterizes the business cycle. Capital appreciation will tend to fluctuate with the market. It may be negative in times of economic contraction. However, the income from infrastructure is less volatile due to the nature of the asset class: essential services guaranteed through multi-year contracts with high-quality counterparties.

Infrastructure investments are a hedge against inflation. In periods of high inflation, essential use assets are affected the least by rising prices because the demand for these services is unlikely to change.

Because physical property makes up much of the value of an infrastructure holding, a good portion of the distributions received by investors can be categorized as return of capital, which is generated through the depreciation of an asset and will defer taxes until the asset is sold and any excess value is realized.

Infrastructure investments can substantially mitigate downside risk during market downturns, providing welcome diversification for a portfolio.

Sources: Bloomberg, Preqin, Brookfield.

Disadvantages

While the advantages of infrastructure are compelling, investors should recognize the following considerations before making an allocation:

Illiquidity: Most infrastructure investments are highly illiquid. On the fund level, investors may have to tie up their money for years before they can withdraw their principal. Even within a fund, there are a limited number of buyers for these massive assets, so investment managers may have trouble offloading holdings at favorable prices if they need to satisfy redemptions.

Complexity: The decisions involved in running a power plant and the assumptions inherent in building a bridge are intricate and complex. It may be difficult for investors to understand the nuanced infrastructure market fully. Investors should select a manager with enough experience to appreciate and thrive in the complexity of this market.

Political Risk: Some of the most influential forces in the world of infrastructure are the governments of the countries in which projects are developed and implemented. At different times, they can act as the seller, the buyer, and/or the regulatory body of infrastructure assets. It is vital that an investment manager underwrites infrastructure assets without assuming the presence of government subsidies or tax credits and remains appropriately diversified across sectors and regions so that one decision cannot singlehandedly imperil the portfolio’s objective.

At a time when expectations for public market returns are uncertain, private infrastructure has the potential to be an attractive diversifier for many portfolios. These assets produce income, hedge inflation, are often tax-advantaged, and minimize downside risk. Infrastructure managers must be evaluated carefully to ensure that they are taking precautions against the risks associated with this asset class. However, when the need to replace antiquated assets is coupled with favorable conditions for investors, an investment in infrastructure may benefit asset managers, investors, and communities worldwide.

[1] Source: J.P. Morgan Guide to the Markets, FactSet, Standard & Poor’s. Data as of 12/31/2024.

[2] Source: Blackrock Student of the Market, Morningstar, St. Louis Federal Reserve. Data as of 11/30/2024.

[3] Source: The International Renewable Energy Agency, Versus Capital.