Could Your Family Benefit from an Independent, Outsourced Chief Investment Officer? Part V

By Richard Todd

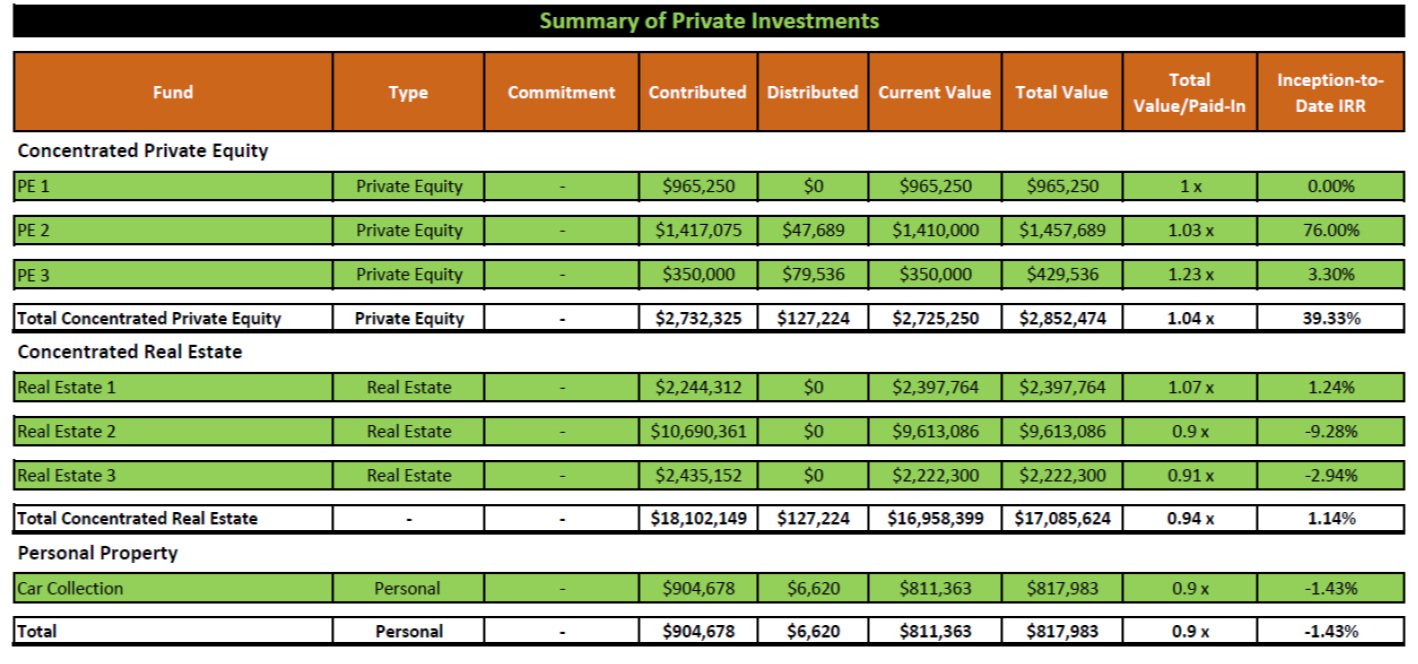

Private equity and real estate investment reporting is often inconsistent, especially if the investments are funded through capital calls. These investments should be included in the total return of the combined portfolio, and the internal rate of return should be calculated for each investment. Often, families can overstate their success with private equity, as successes often overshadow poor investments that can drag performance. Accuracy is important to grasp the big picture, and performance can be segmented by sector or strategy (venture, late stage, technology, energy, etc). Please see Figure 5 for a sample of private equity and real estate reporting.

Case Study: Reporting

Situation: An extremely security-conscientious individual had many accounts and multiple custodians. The individual also did his/her own trading and had partnerships set up for various family members. This format created the inability to view the big picture of the combined portfolios, including the overall risk/return profile.

Independent OCIO Solution: Custom reporting was implemented which included entering all aspects of the portfolios each month and reflected the ownership of each portfolio within the performance and market values of the individual portfolios. This custom reporting allowed the individual to have a big-picture allocation view, transaction details to simplify tax reporting, custom cash flow that led to catching a miscalculation, and, most importantly, the individual did not compromise his/her security requirements.

Liquidity

During the 2008 downturn, many investors were caught off guard by the lack of liquidity in their portfolios. Capital calls came at an accelerated pace from private equity investments, and margin calls were frequent. Many investors were forced to sell their most liquid investments – often selling equities near the bottom of the market. These problems could have been prevented or mitigated through good recordkeeping and discussing the liquidity characteristics of private equity, hedge funds, real estate funds, structured products and other alternative investments in advance of investing. Figure 6 is a sample liquidity schedule that addresses the aforementioned characteristics and liquidation timeframes. The schedule tracks the percentage of the portfolio that can be liquidated in various timeframes and assists the family with determining if the liquidity profile of the portfolio is consistent with the family’s overall objectives and cash needs. As shown, only 65.4 percent of this sample portfolio is liquid within one week, and 94.8 percent of the portfolio can be liquidated within one year.