The Volatile Start to 2025 and How to Manage Potential Uncertainties

Written By Sloan Smith, CAIA, MBA, CPWA®

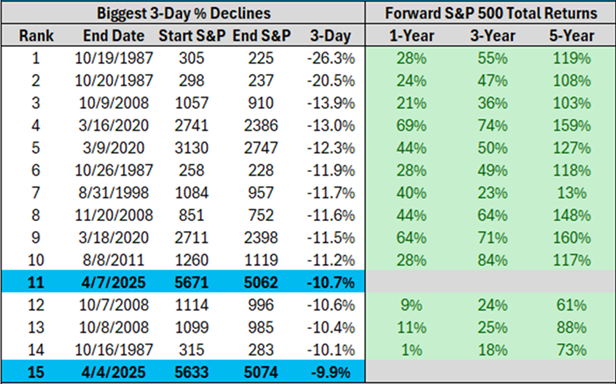

The beginning of 2025 has been quite a ride for market participants. After two strong years in the equity markets, greater uncertainties have arisen. Recently, volatility has been driven primarily by stretched valuations in the United States equity market, concerns surrounding inflation and monetary policy, and, most importantly, changes in trade policy, including tariffs. With the new presidential administration, negotiations surrounding trade have created substantial short-term movements in the marketplace. On April 2, 2025, President Trump enacted global reciprocal tariffs to address issues such as U.S. trade deficits, national security, domestic manufacturing, and drug trafficking. These actions had an immediate impact on global equity markets. There were concerns surrounding increased inflation on consumer goods, disruptions within business supply chains, international trade relations, and the economic impact, as well as whether it could initiate a recession. At one point, the S&P 500 experienced a three-day drawdown of 10%, which is the largest drop in value in the index since the Global Financial Crisis in 2008. However, even though uncertainties have increased, there are still many ways to benefit from the calamities in the market. Ultimately, it is essential to maintain a diversified portfolio while remaining patient with a long-term view. Investors who have a sound asset allocation and a prudent plan for their portfolio usually find the most success during these turbulent times.

Strategies for asset allocations during heightened market volatility:

1. Focusing on asset allocation plan and downside risk

It is essential to review your portfolio’s asset allocation. By utilizing a custom, forward-looking approach that focuses extensively on downside risk, this process provides insights into both the average annual return over the next five to ten years and the potential loss it could incur in a one-year period during a difficult market environment. During times of greater market volatility, investors sometimes forget this exercise and start to panic when they begin to see the value of their accounts diminish. However, a strong, diversified portfolio should help mitigate risk during periods of greater market turbulence. For example, when the S&P 500 experienced a peak-to-trough drawdown of 10% in early April 2025, many Innovest portfolios were only down a few percentage points.

2. Rebalancing

When equity markets experience a significant drawdown, it is best to review your portfolio and consider rebalancing back to your target asset allocation. For example, suppose a portfolio becomes significantly underweight in its target allocation in equities. In that case, it is best to trim other areas of the portfolio that are more stable, such as fixed income, and use these dollars to reinvest in equities. For many investors, this process may seem concerning, considering this asset class may experience greater volatility. However, it is a prudent approach to rebalance and reinvest dollars in areas that are below the portfolio’s long-term asset allocation. This exercise was incredibly valuable during the start of the COVID-19 pandemic in 2020 and the Global Financial Crisis in 2008. Portfolios that remained invested benefited from the significant recovery in the equity markets.

3. Tax-Loss Harvesting

For taxable investors, periods of volatility can hinder returns but can assist in reducing tax liabilities through tax-loss harvesting. Tax-loss harvesting involves selling securities that have declined in value to realize a capital loss, which can then be used to offset capital gains or profits from other investments. For example, at the beginning of the COVID-19 pandemic in 2020, the S&P 500 dropped over 30% in a matter of weeks. In addition to rebalancing portfolios, Innovest began selling parts of the portfolio that experienced significant losses and reinvested these dollars in relatively similar securities to maintain a fully allocated portfolio. In the end, the market experienced a significant rally during the remainder of 2020, and Innovest clients benefitted from capital appreciation and also from tax reduction.

4. Capitalizing on market dislocations

During periods of market stress, parts of a diversified portfolio should be able to capitalize on greater dislocations, helping minimize downside risk and enhance returns. For example, the role of many hedge funds in a portfolio is to provide a differentiated return stream while maintaining low volatility. In a market environment with increased inefficiencies and opportunities, hedge funds should act as both a ballast and potential return driver in the portfolio. The same holds true for opportunistic fixed income, where more tactical bond strategies can capitalize on dynamics in areas such as high yield, floating rate, or even emerging market debt.

The outcomes resulting from headline items in 2025, such as inflation, monetary policy, and tariffs, remain unknown. However, staying disciplined and following a plan through a robust asset allocation is key. The late Charlie Munger said, “the big money is not in the buy or the selling, but in the waiting.” This recent volatility appears to mimic all the other moments in history when there were significant concerns about the investment markets. Patient investors who had a long-term approach, rebalanced their portfolios, utilized tax-loss harvesting, and trusted part of their diversified portfolio to identify market dislocations found the most success. Following a similar approach in 2025 could lead to comparable results.